College costs are ludicrous.

This is a little off-topic per my usual posts but it’s an important one and is top-of-mind for me right now. My daughter is currently a junior in high school so I’ve been doing a lot of thinking about college. There has been a lot of attention lately in the media around college debt because it just surpassed 1.5 trillion. If I wasn’t in the throes of visiting colleges, thinking about where to send my daughter and talking to other parents about the same, I’d be astounded that this could happen. However, the forces that brought this to be are at work on me and I can feel them pulling.

Financial Facts

Most of the colleges that have hit our radar would come with a price tag of about $70,000 per year, including room and board. These are both private universities and ‘out-of-state’ schools. Extrapolate that for four years and we’re talking about $280,000 – let’s call this “School A”. Schools where we would qualify for in-state tuition are still pricey but comparatively a bargain at roughly $25,000 per year. This is $100,000 for four years – let’s refer to this as “School B”.

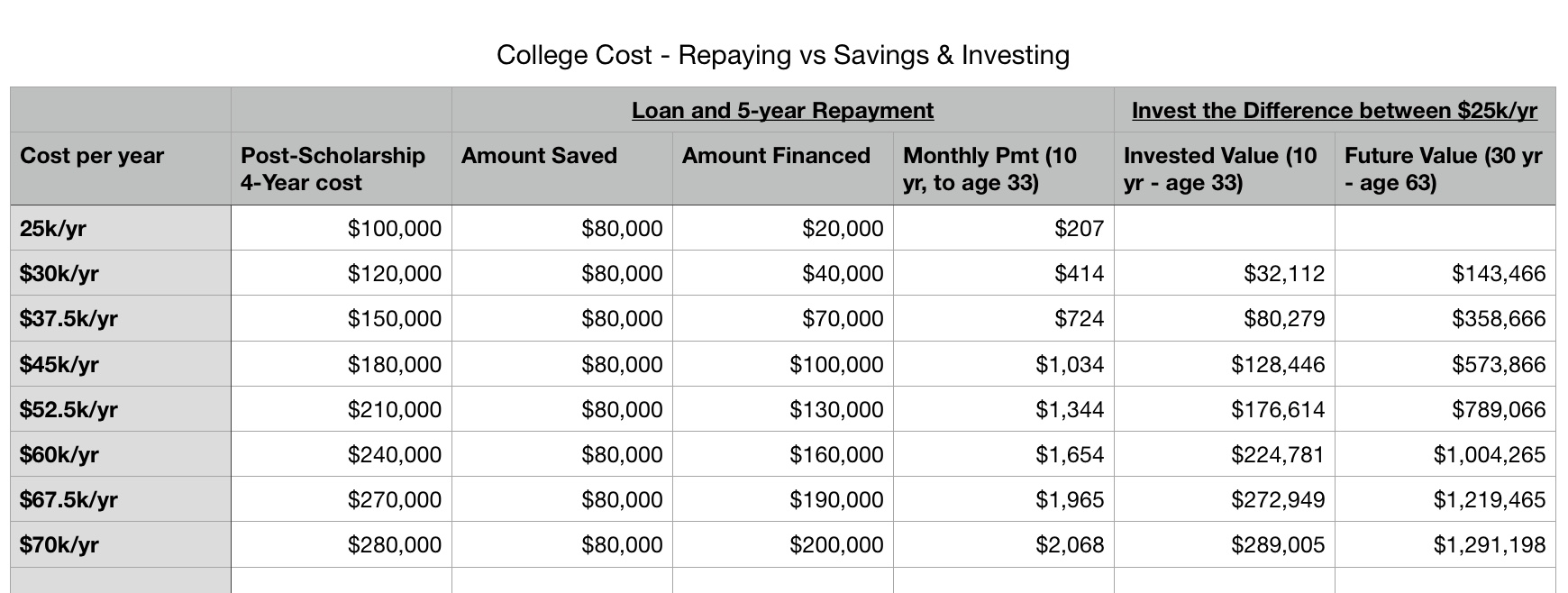

Now let’s talk about the associated debt for the two scenarios above. If you have accumulated, say, $80k in a 529 account, the difference in loan payments between School A and School B are about $1800/mo for 10 years after graduation. If your student opts for School B and invests this difference for 10 years (debt repayment period) and hold with no further savings until age 63, she will have accumulated a nest-egg of $1.2 million. See table below.

It follows that strictly from a numbers and perspective, you would only opt for School A, if upon graduation you would net an additional $1800/mo. With taxes this grosses up to about an additional $30,000/year in salary, and this is just to make the payments without saving a dollar.

Why We Take the Gamble

This is the risk/reward proposition – will our future graduates command greater than $30k/year salary by attending a prestigious (read: “really expensive”) private university? Its a balance that everyone should consider carefully.

But we want the very best for our children, and this is the ‘pull’ that we feel. There is guilt associated with prioritizing our retirement goals over a sending our children to the school of their choice. This is especially true if they have the grades to get them admitted. The statistics put forth by these universities present the best possible picture of their graduation outcomes. Could we with a clean conscience give our children what is made out to be a “lesser” education ? This is at the core of the dilemma.

Entitlement

At one of the college tours we went on, my daughter and I sat in the auditorium listening to one of the college professors talk about the college and its programs. At the end of the talk during the question and answer session, one of the prospective students raised their hand and asked, “What will this college guarantee me upon graduation?”. The professor giving the talk gave the right answer, which was basically, “Nothing”. But I thought it was an interesting insight into the thought process of students making college decisions today. One could argue that attending a school with academic rigor but lacking in prestige is more likely to foster a “go get it” attitude, and the grit required to achieve success.

I should mention that I attended a state school myself. I’ve since been fortunate to have plenty of opportunity and more than my share of professional success – both of which I’m very grateful for. My views have certainly been influenced based on my experiences, so take all this for what it’s worth.

Conclusion

College debt hits graduates during the years where the future value of money is on their side. Taking on massive debt during these prime savings years puts them at a huge disadvantage when it comes to meeting savings goals. Additionally, it validates escalating tuition costs that universities have been implementing and is continuing to fuel the system.

State and community colleges represent a relative value in education, and is a great place to start especially while our young adults are figuring out who they are and what they want to do.

Private universities are the worst offenders, and will soon be punished by the economics that they are bringing upon themselves. It’s a bubble waiting to pop.

Great read. Our son is finishing up his freshman year so these issues are right around the corner for us. Thanks for breaking down the math.

Thanks Greg, and good luck with the college search!